36+ what is mortgage interest deduction

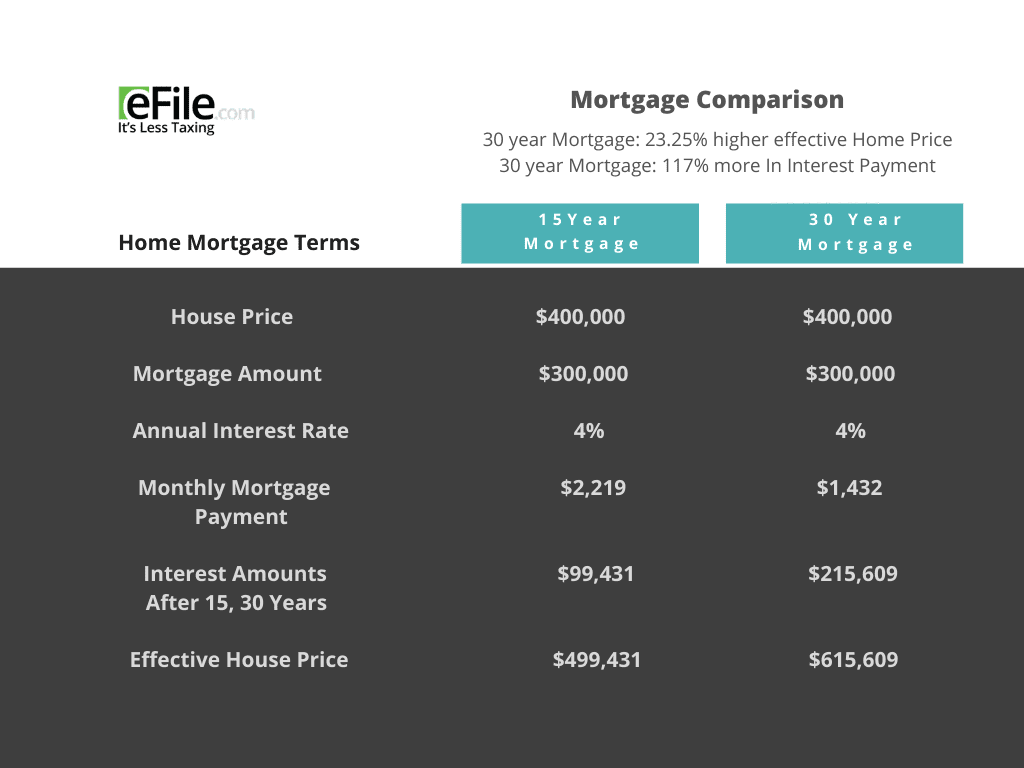

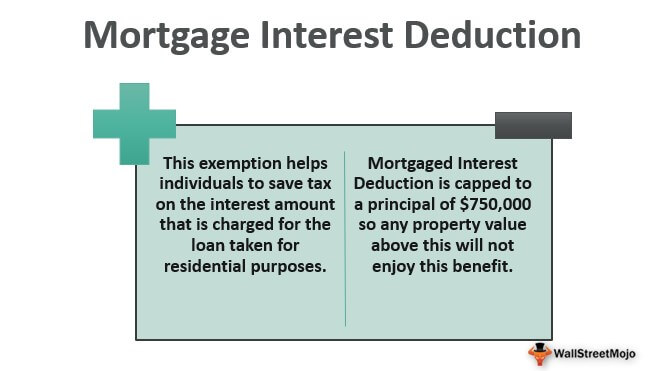

Web Under the Tax Cuts and Jobs Act TCJA the interest is deductible on acquisition debt up to a 750000 threshold for 2018 through 2025 down from 1 million. 30 x 12 360.

Mortgage Interest Deduction Bankrate

Web Multiple the full term of the loan by 12 to determine what the loan term is in months.

. Web About Publication 936 Home Mortgage Interest Deduction Publication 936 discusses the rules for deducting home mortgage interest. The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web The mortgage interest deduction can also apply if you pay interest on a condo cooperative mobile home boat or RV used as a residence. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to. We dont make judgments or prescribe specific policies. Web Home mortgage interest.

Web The mortgage interest deduction is a common itemized deduction that allows homeowners to deduct the interest they pay on any loan used to build purchase. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as. Web What counts as mortgage interest.

Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. However higher limitations 1. Answer Simple Questions About Your Life And We Do The Rest.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. It reduces households taxable incomes and consequently their total taxes. See what makes us different.

Web Important rules and exceptions. Divide the cost of the points paid by the full term of the loan in. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

For tax year 2022 those amounts are rising to. Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Web How the Mortgage Interest Deduction May Not Help. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. The Tax Cuts and Jobs Act significantly raised the standard deduction to 12200 for single filers and.

Mortgage Interest Deduction Or Standard Deduction Houselogic

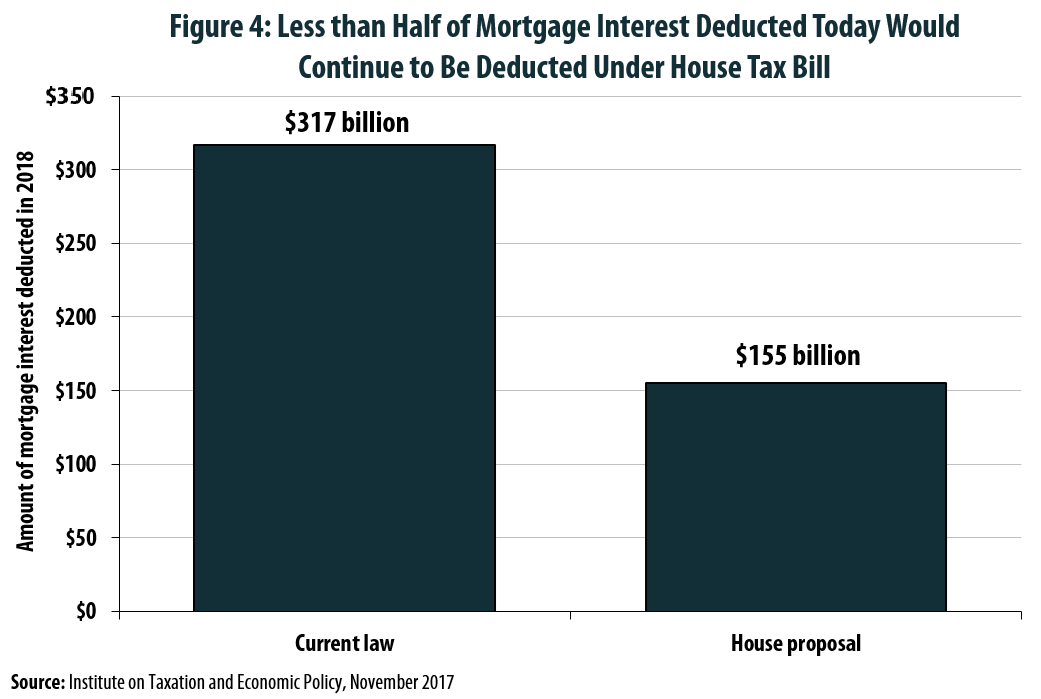

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Home Mortgage Loan Interest Payments Points Deduction

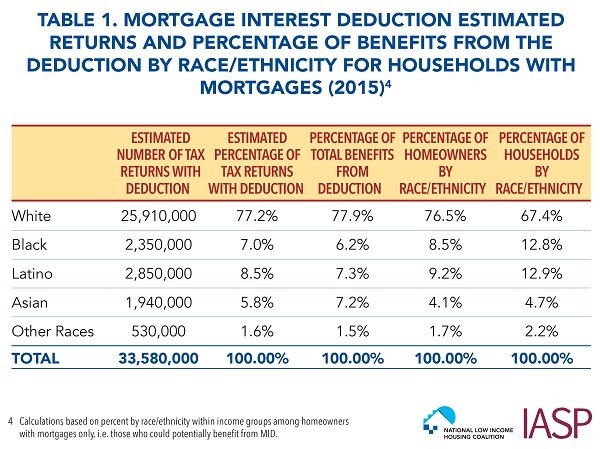

Race And Housing Series Mortgage Interest Deduction

Haiboxing Remote Control Car 2 4ghz 1 18 Proportional 4wd 36 Km H Hobby Rc Car Offroad Monster Rc Truck Waterproof Rc Truggy Rtr Off Road Toy Amazon De Toys

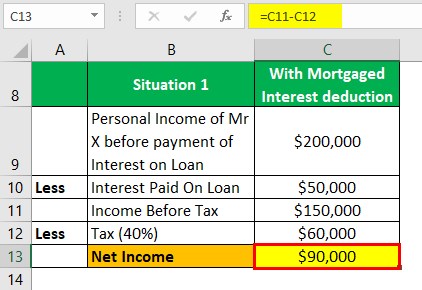

Mortgage Interest Deduction How It Calculate Tax Savings

The History And Possible Future Of The Mortgage Interest Deduction

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Deduction Rules Limits For 2023

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

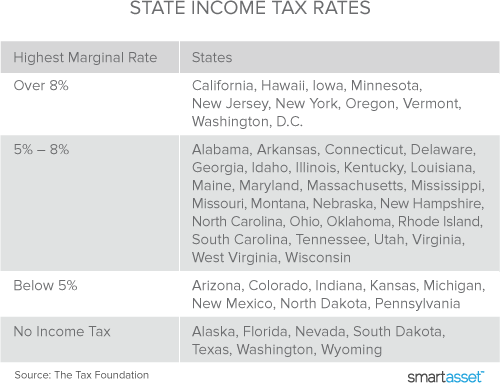

Mortgage Interest Tax Deduction Smartasset Com

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

Mortgage Interest Deduction How It Calculate Tax Savings

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

What Are The Possible Ways To Legally Save Income Tax For Salaried Person In India In 2022 Quora

Mortgage Interest Deduction Changes In 2018